Pharmaceutical Packaging Laminates Market Trends for 2026

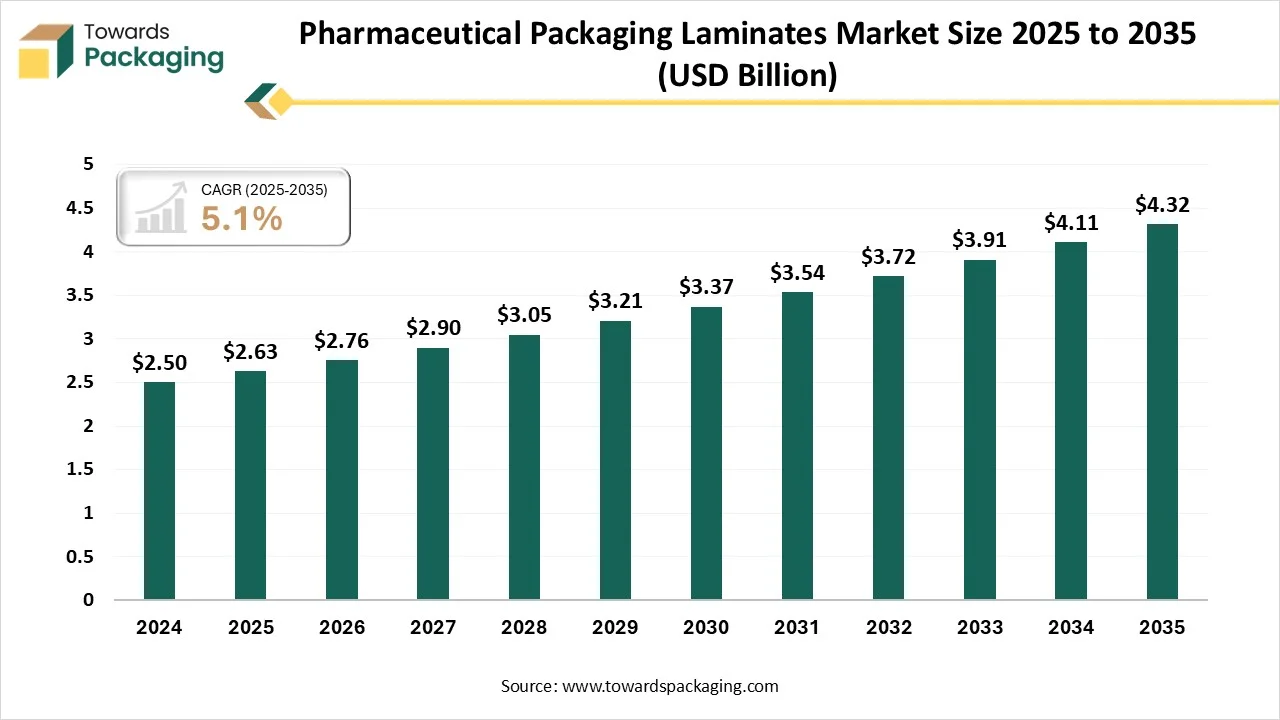

According to Towards Packaging consultants, the global pharmaceutical packaging laminates market is projected to reach approximately USD 4.32 billion by 2034, increasing from USD 2.63 billion in 2025, at a CAGR of 5.1% during the forecast period 2025 to 2034.

Ottawa, Jan. 21, 2026 (GLOBE NEWSWIRE) — The global pharmaceutical packaging laminates market size was recorded at USD 2.63 billion in 2025 and is forecast to increase to USD 4.32 billion in 2034, as per findings from a study published by Towards Packaging, a sister firm of Precedence Research. The pharmaceutical packaging laminate market is witnessing steady growth driven by rising pharmaceutical production, increasing demand for high-barrier and tamper-resistant packaging, and strict regulatory requirements for drug safety.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Pharmaceutical Packaging Laminates?

Pharmaceutical packaging laminates refer to multi-layered material structures used to protect medicines from moisture, oxygen, light, and contamination, ensuring product stability, safety, and extended shelf life. These laminates combine materials such as plastic films, aluminum foil, and paper for blister packs, sachets, and pouches.

The pharmaceutical packaging laminates market is driven by rising drug production, growth in generic medicines, increasing healthcare consumption, strict regulatory standards, demand for patient-friendly packaging, and continuous advancements in high-barrier, sustainable, and lightweight packaging technologies.

Major Government Initiatives for the Pharmaceutical Packaging Laminates Industry:

- Production Linked Incentive (PLI) Scheme for Pharmaceuticals: This scheme provides financial incentives to manufacturers of high-value goods, including complex excipients and specialized packaging materials like empty capsules and complex laminates, to boost global competitiveness.

- Strengthening of Pharmaceutical Industry (SPI) Scheme: Through its Assistance to Pharmaceutical Industry for Common Facilities (API-CF) sub-scheme, the government provides grants to clusters for creating shared testing and R&D labs essential for developing advanced packaging materials.

- Revamped Pharmaceuticals Technology Upgradation Assistance Scheme (RPTUAS): This initiative offers subsidies to MSMEs to upgrade their production facilities to meet international standards such as WHO-GMP, which is critical for high-grade laminate manufacturing.

- National Logistics Policy (NLP): By integrating digital systems and developing multi-modal logistics parks, the NLP aims to reduce transit costs and improve the specialized handling required for temperature-sensitive pharmaceutical packaging.

- Make in India & Atmanirbhar Bharat: These broader frameworks encourage self-reliance and have led to 100% Foreign Direct Investment (FDI) for greenfield projects, facilitating the entry of advanced international laminate technology into the domestic market.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5923

What Are the Latest Key Trends in the Pharmaceutical Packaging Laminates Market?

1. Sustainability & Eco-friendly Materials:

There is a strong shift toward recyclable, biodegradable, and mono-material laminates to reduce waste and meet strict environmental regulations and consumer demand for greener pharma packaging. Manufacturers are reformulating materials and coatings to improve recyclability without compromising protection.

2. Smart & Active Packaging Technologies:

Integration of smart features such as QR codes, NFC/RFID tags, and sensors is increasing. These technologies enhance traceability, anti-counterfeiting measures, and real-time monitoring of storage conditions, improving patient safety and supply chain transparency.

3. Advanced Barrier & High-Performance Laminates:

Innovative multilayer structures and high-barrier films (e.g., PVDC or advanced composites) are being adopted to protect sensitive drugs from moisture, oxygen, and light, extending shelf life and maintaining efficacy.

4. Lightweighting & Cost Optimization:

Producers are optimizing laminate thickness and adhesive layers to reduce material use and transportation costs. Lightweight designs support sustainability goals while maintaining packaging integrity and performance.

5. Automation & Digital Printing:

Automation of manufacturing processes and the adoption of digital printing technologies are rising. These enhance production efficiency, reduce lead times, and allow customizable, high-quality graphics for better brand differentiation.

What is the Potential Growth Rate of the Pharmaceutical Packaging Laminates Industry?

The pharmaceutical packaging laminates industry is driven by rising pharmaceutical production, growing demand for generic and specialty drugs, and the need for high-barrier packaging to protect medicines from moisture, oxygen, and contamination. Strict regulatory requirements for drug safety and quality further support market growth.

Increasing healthcare consumption, expansion of blister and sachet packaging, demand for patient-friendly formats, and continuous advancements in lightweight, sustainable, and high-performance laminate materials are also key growth drivers.

More Insights of Towards Packaging:

- Airless Packaging Market Size and Segments Outlook (2026–2035)

- Pre-made Pouch Packaging Market Size, Trends and Segments (2026–2035)

- Corrugated Mailers Market Size, Trends and Regional Analysis (2026–2035)

- Green Packaging Film Market Size, Trends and Regional Analysis (2026–2035)

- Transit Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Paper Machinery Market Size, Trends and Segments (2026–2035)

- Semiconductor Packaging Market Size, Trends and Segments (2026–2035)

- Adherence Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ethical Label Market Size, Trends and Competitive Landscape (2026–2035)

- Wine Packaging Market Size, Share, Trends, Segments, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape to 2034

- Bioplastic Packaging Market Size and Segments Outlook (2026–2035)

- Certified-Circular Plastic Market Analysis and Regional Outlook (2026–2035)

- PE-Free Wrappers Market Size and Segments Outlook (2026–2035)

- Agricultural Films Market Size, Trends, Segments, Regional Insights & Competitive Landscape 2025-2034

- Automotive Plastic Compounding Market Size & Business Model Innovation

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis

- Plastic Healthcare Packaging Market Size, Trends and Segments (2026–2035)

- Liquid Carton Packaging Market Size, Trends and Segments (2026–2035)

- Sustainable Foodservice Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Micro Packaging Market Size and Segments Outlook (2026–2035)

Regional Analysis:

Who is the leader in the Pharmaceutical Packaging Laminates Market?

North America dominates the market due to its strong pharmaceutical manufacturing base, advanced healthcare infrastructure, and strict regulatory standards for drug safety and packaging quality. High adoption of innovative, high-barrier laminate technologies, presence of major packaging manufacturers, strong R&D investments, and growing demand for sustainable and patient-centric packaging solutions further support regional dominance.

U.S. Pharmaceutical Packaging Laminates Market Trends

The U.S. dominates the North American market due to its large pharmaceutical and biotechnology industry, high drug consumption, and strong focus on innovation. Strict FDA regulations drive demand for high-quality, compliant packaging. The presence of leading packaging manufacturers, advanced manufacturing capabilities, strong R&D investment, and early adoption of sustainable and smart laminate technologies further strengthen the country’s market leadership.

How is the opportunity in the Rise of the Asia Pacific in the Pharmaceutical Packaging Laminates Market?

Asia-Pacific is the fastest-growing region in the market due to the rapid expansion of pharmaceutical manufacturing, increasing generic drug production, and rising healthcare consumption across emerging economies. Growing population, improving healthcare infrastructure, cost-effective manufacturing, expanding exports, and increasing regulatory focus on safe and high-barrier packaging are accelerating demand for advanced pharmaceutical packaging laminate solutions.

China Pharmaceutical Packaging Laminates Market Trends

China dominates the Asia-Pacific market due to its large pharmaceutical manufacturing base, high domestic drug consumption, and strong export-oriented production. Cost-efficient manufacturing, availability of raw materials, rapid expansion of generic medicines, government support for pharmaceutical growth, and increasing adoption of high-barrier and compliant packaging solutions further strengthen China’s leading position.

How Big is the Success of the European Pharmaceutical Packaging Laminates Industry?

Europe is growing at a notable rate in the market due to strong pharmaceutical research and manufacturing capabilities, rising demand for high-quality and compliant drug packaging, and strict regulatory frameworks. Increasing focus on sustainability, adoption of recyclable and mono-material laminates, growth in biologics and specialty drugs, and continuous technological advancements in high-barrier packaging solutions further support regional growth.

The UK Pharmaceutical Packaging Laminates Market Trends

The UK is growing at the fastest rate in the European market due to its expanding pharmaceutical market size, strong biopharmaceutical research base, and rising demand for compliant packaging solutions. Favourable regulatory support, increasing investment in sustainable laminates, advanced manufacturing capabilities, and a positive PBR reflecting improving profitability and demand further accelerate the country’s market growth.

How Crucial is the Role of Latin America in the Pharmaceutical Packaging Laminates Market?

Latin America is growing at a considerable rate in the market due to expanding pharmaceutical manufacturing, rising healthcare expenditure, and increasing access to medicines across developing economies. Growth in generic drug production, improving regulatory frameworks, rising exports, and growing demand for cost-effective, high-barrier, and moisture-resistant packaging solutions are further supporting regional market expansion.

How Big is the Opportunity for the Growth of the Middle East and Africa Pharmaceutical Packaging Laminates Industry?

The Middle East and Africa region offers strong growth opportunities in the market due to expanding healthcare infrastructure, increasing pharmaceutical production, and rising demand for safe and durable medicine packaging. Government initiatives to localize drug manufacturing, growing imports of finished pharmaceuticals, improving regulatory standards, and the need for moisture- and heat-resistant packaging in harsh climates further enhance regional growth potential.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Material Type Insights

What Made the Aluminum-Based Laminates Segment Dominant in the Pharmaceutical Packaging Laminates Market in 2025?

The aluminum-based laminates segment dominates the market due to its excellent barrier properties against moisture, oxygen, and light, ensuring drug stability and extended shelf life. High durability, compatibility with blister packs, and widespread adoption by pharmaceutical manufacturers contribute to its market leadership. Strong CHR and robust demand across generic and specialty drugs reinforce its dominance.

The aluminium plastic composite laminate segment is the fastest-growing in the market due to its lightweight, flexible, and high-barrier properties. It offers superior protection against moisture, oxygen, and contamination while reducing material usage and transportation costs. Rising demand for patient-friendly packaging, sustainable solutions, and innovative drug delivery formats further accelerates the segment’s growth.

Application Insights

How the Blister Packaging Dominated the Pharmaceutical Packaging Laminates Market in 2025?

The blister packaging segment dominates the market due to its superior protection of tablets, capsules, and small medical devices from moisture, oxygen, and contamination, ensuring product stability and extended shelf life. High consumer convenience, accurate dosage management, compliance with stringent regulatory standards, and compatibility with automated packaging lines further strengthen its market leadership.

The unit dose and child-resistant packaging segment is the fastest-growing in the market due to increasing focus on patient safety, accurate dosage administration, and prevention of accidental ingestion. Rising demand for pediatric and elderly medications, stringent regulatory requirements, and growing adoption of innovative, tamper-evident, and user-friendly packaging solutions further accelerate the segment’s rapid growth.

Drug Form Insights

Which Factors Make the Solid Oral Drugs Segment the Dominant Segment in the Pharmaceutical Packaging Laminates Market in 2025?

The solid oral drug segment dominates the market due to the widespread use of tablets and capsules, which require high-barrier protection against moisture, oxygen, and light to maintain stability and efficacy. High global demand for oral medications, ease of administration, cost-effectiveness, and compatibility with blister and sachet packaging further reinforce the segment’s market leadership.

The biologics and specialty drug segment is the fastest-growing in the market due to the increasing production of complex and sensitive drugs that require advanced high-barrier and temperature-controlled packaging. Rising demand for personalized medicines, strict regulatory standards, and the need for secure, tamper-evident, and patient-friendly packaging solutions further accelerate the segment’s rapid growth.

End-User Insights

What made the Pharmaceutical Manufacturers Segment Dominant in the Pharmaceutical Packaging Laminates Market in 2025?

The pharmaceutical manufacturer segment dominates the market due to the high demand for safe, high-quality, and compliant packaging for tablets, capsules, biologics, and specialty drugs. Strong adoption of advanced laminates, focus on regulatory compliance, large-scale production capacities, and continuous investment in innovative, sustainable, and high-barrier packaging solutions further reinforce the segment’s market leadership.

The biopharmaceutical companies’ segment is the fastest-growing end-user in the market due to the rising production of biologics, vaccines, and specialty drugs that require advanced, high-barrier, and temperature-controlled packaging. Increasing focus on drug safety, patient-centric packaging, stringent regulatory compliance, and adoption of innovative, tamper-evident, and sustainable laminates further drive rapid segment growth.

Recent Breakthroughs in Pharmaceutical Packaging Laminates Industry

- In April 2025, Amcor completed construction of a high-level coating facility for healthcare packaging in Selangor, Malaysia, aimed at producing high-barrier laminates for sensitive drugs. This expansion allows Amcor to increase production capacity for moisture- and oxygen-resistant packaging while focusing on sustainable and recyclable materials.

- In May 2025, Colorcon partnered with ASHA Cellulose to develop advanced ethyl cellulose solutions for controlled atmosphere and specialty pharmaceutical packaging. This collaboration focuses on creating laminates that provide superior barrier protection, are compatible with sustainable materials, and maintain drug stability.

Top Companies in the Global Pharmaceutical Packaging Laminates Market & Their Offerings:

Tier 1:

- Amcor plc provides recycle-ready high-barrier laminates for sachets, stickpacks, and strippacks.

- Uflex Limited manufactures cold form alu laminates, strip foil, and child-resistant foil with anti-counterfeiting features.

- Tekni-Plex, Inc. offers extrusion and adhesive laminates with various barrier properties (Aclar® PCTFE, PVDC) for blister lidding and pouches.

- EPL Limited (formerly Essel Propack Ltd) specializes in aluminum and plastic barrier laminated tubes for pharmaceutical creams and ointments.

- Berry Global Group, Inc. offers a wide range of rigid and flexible protective solutions, including barrier films and laminates.

- Huhtamaki Oyj provides flexible packaging laminates for sachets and blister foils, focusing on product protection and safety.

- Mondi Group plc offers functional films and laminates for medical and pharmaceutical applications, ensuring high barrier protection.

- Constantia Flexibles Group GmbH specializes in high-barrier pharmaceutical foil-based packaging like coldform foil and blister lidding.

- Sealed Air Corporation offers packaging solutions in healthcare focusing on protection and sterile barriers for medical devices, which includes various film structures.

- Coveris Holdings S.A. provides films and laminates for the medical and pharmaceutical sectors with barrier control, puncture resistance, and sterile barrier capabilities.

Tier 2:

- Toray Industries, Inc.

- Dai Nippon Printing Co., Ltd.

- ProAmpac LLC

- Glenroy, Inc.

- Clondalkin Group Holdings B.V.

- Sharp Packaging Services

- Guala Pack S.p.A.

- Ropack Pharma Solutions

- Schur Flexibles Group

- Fresenius Kabi AG

- Oliver Healthcare Packaging

- AptarGroup, Inc.

- Sonoco Products Company

Segment Covered in the Report

By Material Type

- Aluminum-based laminates

- Plastic-based laminates (PVC, PVDC, PET, PP) – Significant share

- Paper-based laminates – Niche usage

- Aluminum-plastic composite laminates

By Application

- Blister packaging

- Strip packaging

- Sachets & pouches

- Bags & liners

- Unit-dose and child-resistant packaging

By Drug Form

- Solid oral drugs (tablets & capsules)

- Liquid drugs

- Topical drugs

- Injectable drugs

- Biologics & specialty drugs

By End User

- Pharmaceutical manufacturers

- Contract packaging organizations (CPOs)

- Contract development & manufacturing organizations (CDMOs)

- Biopharmaceutical companies

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5923

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight – Check It Out:

- Boxboard Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Corrugated Plastic Tray Market Size and Segments Outlook (2026–2035)

- Topical Drugs Packaging Market Size and Segments Outlook (2026–2035)

- Tinplate Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Micro Perforated Films for Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Cornstarch Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Reclosable Zipper Market Size, Trends and Segments (2026–2035)

- Bubble Wrap Packaging Market Size, Trends and Segments (2026–2035)

- Rigid Sleeve Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Hazardous Goods Packaging Market Size and Segments Outlook (2026–2035)

- Advanced Recycled Materials (ARM) in Packaging Market Size, Trends and Segments (2026–2035)

- Recyclable Paper Wrapper Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Corrugated Sheets Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape Analysis

- Consumer Goods Sustainable Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape 2026-2035

- Food and Beverage Metal Cans Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Industrial Drums Market Size and Segments Outlook (2026–2035)

- Multi Depth Corrugated Box Market Size, Trends and Regional Analysis (2026–2035)

- Non-Corrugated Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Inflatable Bags Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Heavy Duty Corrugated Packaging Market Size, Trends and Regional Analysis (2026–2035)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaEveningPost.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaEveningPost.com takes no editorial responsibility for the same.