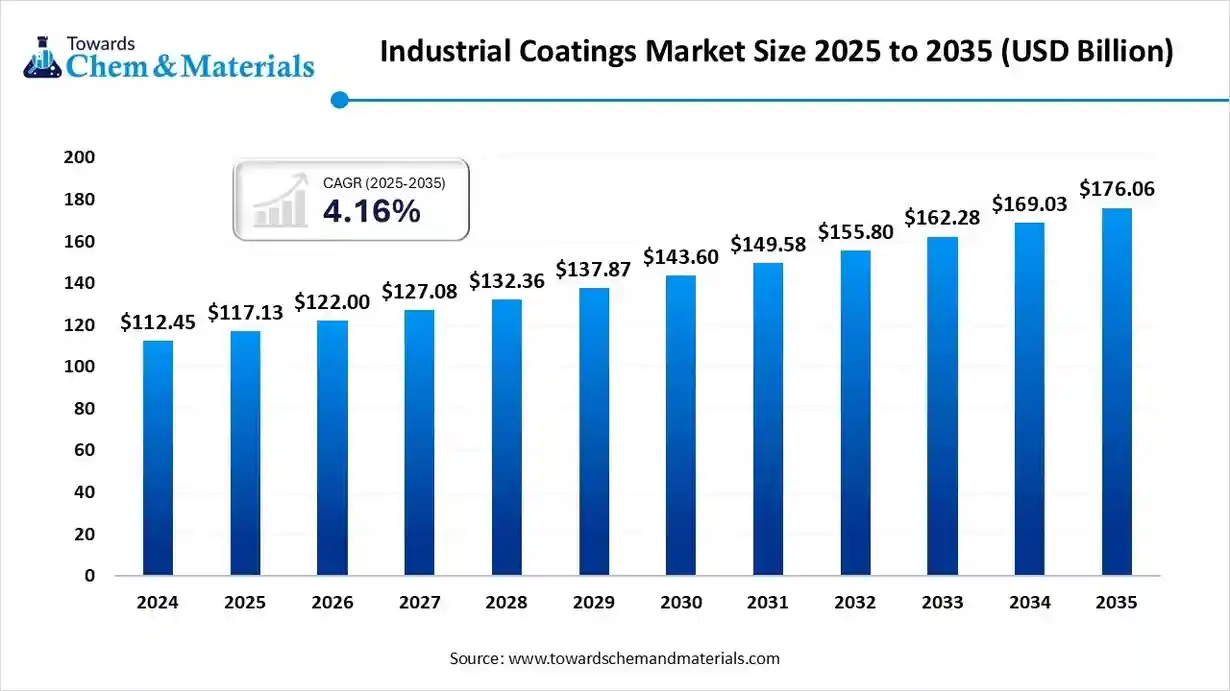

Industrial Coatings Market Size to Surpass USD 176.06 Billion by 2035

The global Industrial Coatings market size was valued at USD 117.13 billion in 2025 and is expected to hit around USD 176.06 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.16% over the forecast period from 2026 to 2035. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

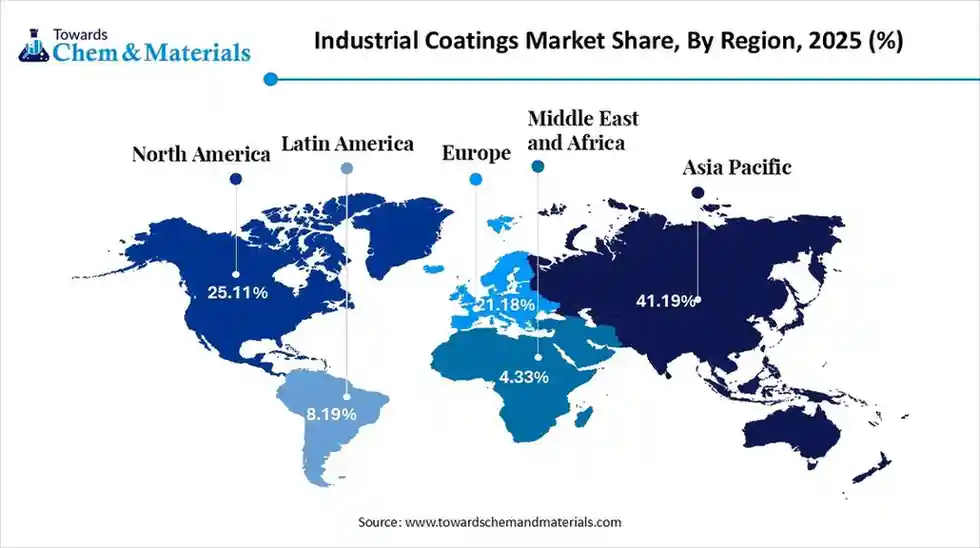

Ottawa, Feb. 21, 2026 (GLOBE NEWSWIRE) — According to Towards Chemical and Materials, the global Industrial Coatings market size is estimated at USD 122 billion in 2026 and is expected to be worth around USD 176.06 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.16% over the forecast period from 2026 to 2035. Asia Pacific dominated the Industrial coatings market with the largest revenue share of 41.19% in 2025. The market is driven by sustainability targets, technological shift, material innovation and regulatory framework in industrial applications.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6021

Revolutionizing Coatings with Sustainability and Innovation

Industrial coatings serve as functional barriers protecting infrastructure from chemical, thermal, and atmospheric damage. They are prominent for operational longevity and are shifting from solvent-based to low-emission technologies such as water-borne, powder, and UV-curable systems. As research emphasizes resin innovation and functionalities like self-healing, anti-microbial, and fire-retardant properties, driving the growth. As the industry is shifting towards global manufacturing health, focusing on decoupling production from environmental impacts through advanced and resource-efficient solutions.

Industrial Coatings Market Report Highlights

- Asia Pacific dominated the global industrial coatings market with the largest revenue share of 40.19% in 2025.

- The industrial coatings industry in China is expected to grow at the fastest CAGR of 4.12% from 2026 to 2035.

- By product, the acrylic segment led the market with the largest revenue share of 37.04% in 2025.

- By product, the acrylic segment is expected to grow at the fastest CAGR of 4.15% from 2026 to 2035.

- By technology, the solvent borne segment led the market with the largest revenue share of 36.80% in 2025.

- By end use, the general industrial segment led the market with the largest revenue share of 46.52% in 2025.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

What Are Major Trends in the Industrial Coatings Market?

- Rapid Shift Towards Sustainable Systems: The market is focused on the replacement of traditional coating systems with high-performance powder, waterborne and UV-curable formulation align with stringent regulations, low VOC and emission standards.

- Electric Vehicle Integration: The rapid shift towards electric mobility is accelerating the development of dielectric and fire-retardant coatings that offer battery enclosure, thermal management and protect high-voltage electronic components.

- Innovation and Smart Coatings: The innovation is driving towards active protective barriers, including self-healing nanocoating that integrates with smart systems like anti-microbial surfaces for healthcare and anti-fouling systems for the maritime industry.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive

USD 3200) @ https://www.towardschemandmaterials.com/checkout/6021

The Role of Industrial Coatings

The coverage of industrial coatings extends widely, with their chief function being to protect equipment from corrosion. The aesthetic value is also crucial for particular equipment and settings. These coatings are commonly applied to safeguard materials like concrete or steel.

Furthermore, industrial coatings play a role in boosting materials’ resistance to fire and other hazards. They are used to line water tanks and reservoirs, ensuring a safe environment for potable water and preventing corrosion.

Polymers are the most prevalent materials for industrial coatings, including epoxy, moisture-cure urethane, polyurethane, and fluoropolymer coatings.

Key Factors in the Industrial Coating Process

Several elements are critical when applying industrial coatings, including the following:

Surface Preparation of the Substrate

To ensure adhesion, the substrate—or base material—receiving the protective layer must be cleaned beforehand. Most coatings rely on either a mechanical or physical bond to adhere to the substrate’s surface. Chemical bonding may also form a strong layer. A surface not properly cleaned of dust, chemicals, or contaminants may lead to premature coating failure.

Proper substrate surface preparation is vital for the successful application of industrial coatings. Before the coating application, the surface should be thoroughly cleaned of moisture, dry contaminants, and salts using methods such as heating, blasting, or chemical cleaning. Effective cleaning mitigates issues like fisheyes, blistering, adhesion failure, alligator Ing, bubbling, and cissing.

Selecting the Appropriate Coating System

Priming is a critical step in any industrial coating process, ensuring the coating and sealant adhere well to the substrate for lasting performance. Primers enhance compatibility between various substrates and coatings, improving final appearance by evening out surface imperfections.

With the primer applied, the substrate is primed for coating. Different coating methods are employed, each aimed at thoroughly covering the substrate’s surface. The method chosen often depends on the substrate’s size and complexity. Popular coating processes include dip, brush, roll, spray, spin, and flow coating.

Curing and Drying Industrial Coatings

The curing and drying practices influence coating performance. Incorrect procedures can undermine coating quality. Each product should come with detailed instructions for ideal drying and curing procedures to maximize results.

Proper curing requires maintaining the right temperature for a specified time on the substrate, not just the oven. Thus, bake times can differ based on the part’s thickness.

Inspection of Coated Parts

Upon completing the coating process, parts should be inspected to meet specific standards. Industrial coatings must meet precise thickness requirements to provide full coverage and reflect all details. Effective inspection policies help ascertain coating projects remain within acceptable thickness ranges.

Choosing a fitting industrial coating requires careful consideration of both the equipment and coating materials. A robust coating setup demands components like durable pump seals, clean filters, and routinely flushed air lines. Poor maintenance may produce suboptimal results.

Suppliers work alongside customers to assess procedures, ensuring workplaces are clean, followed by routine equipment maintenance.

Factors When Creating Custom Industrial Coating Solutions

Consider these factors for a custom industrial coating solution:

Identifying the Substrate

Picking the right formulation hinges on the substrate, often needing materials such as urethane, acrylic, or epoxy. Manufacturers must also factor in the types of materials and when the application takes place during production.

Certain substrate and coating pairings can be matched using suitable primers or additives to bolster binding and other attributes. Specifications, like corrosion resistance or adhering to food safety norms, influence material selection choices.

Various application steps and materials yield different outputs depending on the substrate’s condition. Some substrates, like plastic, need a heat cure to keep the coating intact without causing deformation.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Industrial Coatings Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD122.00 Billion |

| Revenue forecast in 2035 | USD 176.06 Billion |

| Growth rate | CAGR of 4.16% from 2026 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2018 – 2025 |

| Forecast period | 2026 – 2035 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion and CAGR from 2026 to 2035 |

| Report coverage | Volume in kilotons, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product, By Technology, By End-use, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

| Key companies profiled | BASF SE; Akzo Nobel N.V.; Axalta Coating Systems; Jotun; PPG Industries, Inc.; The Sherwin-Williams Company; Nippon Paint Holdings Co., Ltd.; Hempel A/S; RPM International Inc.; Diamond Paints; Kansai Paints |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6021

Industrial Coatings Market Dynamics

Driver

Urbanization and Demand for Anti-Corrosive Coatings

The rising demand for large-scale coatings materials to protect against atmospheric corrosion and mechanical wear, as well as energy grids and commercial hubs, is driving global investment in renewable energy infrastructure. While the expansion is driven by the need for ultra-durable and salt-spray-resistant coating for direct exposure and maritime operations.

Restraints

Raw Material Volatility and Performance Uncertainty

The raw materials, which involve titanium dioxide and resins, show fluctuations in prices that enable uncertainty in production and low profits for major manufacturers. In heavy-duty operation, the specific sustainable alternatives still struggle to replicate extreme adhesion, performance and barrier properties that restrain the adoption.

Opportunity

The Transition to Circular Chemistry and Energy-Efficient Development

The massive opportunity for decoupling of production from fossil fuel by utilizing renewable feedstock to bio-based and recycled feedstock by aligning with the circular economy principle allows an industrial push towards sustainability. While the demand for cool-roof and high-solar-reflectance coatings for large-scale industrial and commercial infrastructure is pivoting a shift towards energy-efficient urban planning.

Empowering innovation with the precision of AI in Industry Coatings

Digital and material science synergy drives the industrial coatings market, with AI accelerating molecular discovery and optimizing application. Machine learning allows virtual testing of numerous formulations, speeding up development and minimizing waste. Digital twin models predict long-term degradation. The integration of Smart nanocoatings with self-healing and anti-microbial features is transforming barriers into active, sensing surfaces. The industry is moving toward precise and resource-efficient models that extend infrastructure lifespan.

Industrial Coatings Market Segmentation Insights

Product Insights

How Did the Acrylic Segment Dominate the Industrial Coatings Market?

The acrylic segment is maintaining its leadership in industrial protection due to its hydrolytic stability, color retention, and clarity, keeping its durability under thermal and chemical stress. Their ability to form high-functionality cross-linked networks enables versatile finishes, from high-gloss to ultra-matte barriers that resist marring and abrasion. Their wetting properties ensure uniformness in complex geometries and a barrier against corrosion. Additionally, acrylic resins combine rapid processing, environmental compliance, and long-term cost-efficiency, making them a reliable choice for modern manufacturing.

The polyurethane segment is anticipated to grow fastest CAGR during the forecast period. Known for its durability and flexibility, with a molecular structure that balances impact resistance and structural adaptability. Polyurethane acts as a resilient shield, absorbing shocks and resisting micro-cracking under thermal changes. The segment focuses on developing high-solids and water-dispersible polyurethane technology vital for high-value infrastructure. Advances include bio-based formulations that create dense barriers against chemicals and moisture, offering automotive-grade finishes with structural reinforcement for tough industrial environments.

Technology Insights

Which Technology Segment Dominates the Industrial Coatings Market?

The solvent borne segment maintains its market dominance, driven by its wetting and film combination, using organic carriers that penetrate surface irregularities for strong bonds. Its hydrophobic integrity forms dense, water-resistant matrices for osmotic blistering and moisture transmission, functioning reliably in extreme humidity ensure consistent curing and smooth, defect-free finishes. They offer high cross-linking density and protection in significant applications, defending against physical stress, chemical immersion, and corrosion. Additionally, this segment is evolving into ultra-high-solid formulation, so these systems maximize asset longevity and performance.

The water-borne segment offers significant growth during the projected period, are key for sustainable engineering, creating durable polymer matrices from aqueous dispersions. Their ability to withstand in a safe environmental profile, eliminating fire hazards and liabilities with flammable solvents by meeting strict air-quality standards. Waterborne technology offers excellent aesthetic stability, resisting UV yellowing and thermal degradation with superior pigment suspension and clarity. These systems offer vibrant, high-gloss finishes that resist household chemicals, abrasion, and moisture, suitable for circular economies

End-Use Insights

How did the General Industrial Segment Dominate the Industrial Coatings Market?

The general industrial segment dominates the market, covering a broad range of manufacturing infrastructure and consumer goods. It demands high-performance barriers for heavy-duty agricultural and construction equipment, electronics, and household appliances. This segment drives technological advancement, adopting UV-curable and powder coatings, offering a mix of aesthetic appeal and mechanical resilience to the operational life of the capital advantage. The segment incorporates smart additives like antimicrobial or self-healing properties to ensure more reliable and modern industrial production.

The automotive and vehicle refinish segment is an emerging segment projected to grow at a CAGR between 2026 and 2035. This segment is defined as a combination of aesthetic engineering with structural strength, using multi-layer coatings using primers and clear coats to protect against UV degradation, chips, and road chemicals. Industry evolution toward low-energy, ultra-high-solids systems, it enables return-to-service time and lower emissions without losing color depth or metallic effects. Additionally, developments in electric vehicle coatings focus on thermal management and dielectric properties for battery safety. This segment ensures vehicles maintain their mechanical and aesthetic value throughout their lifespan.

Regional Insights

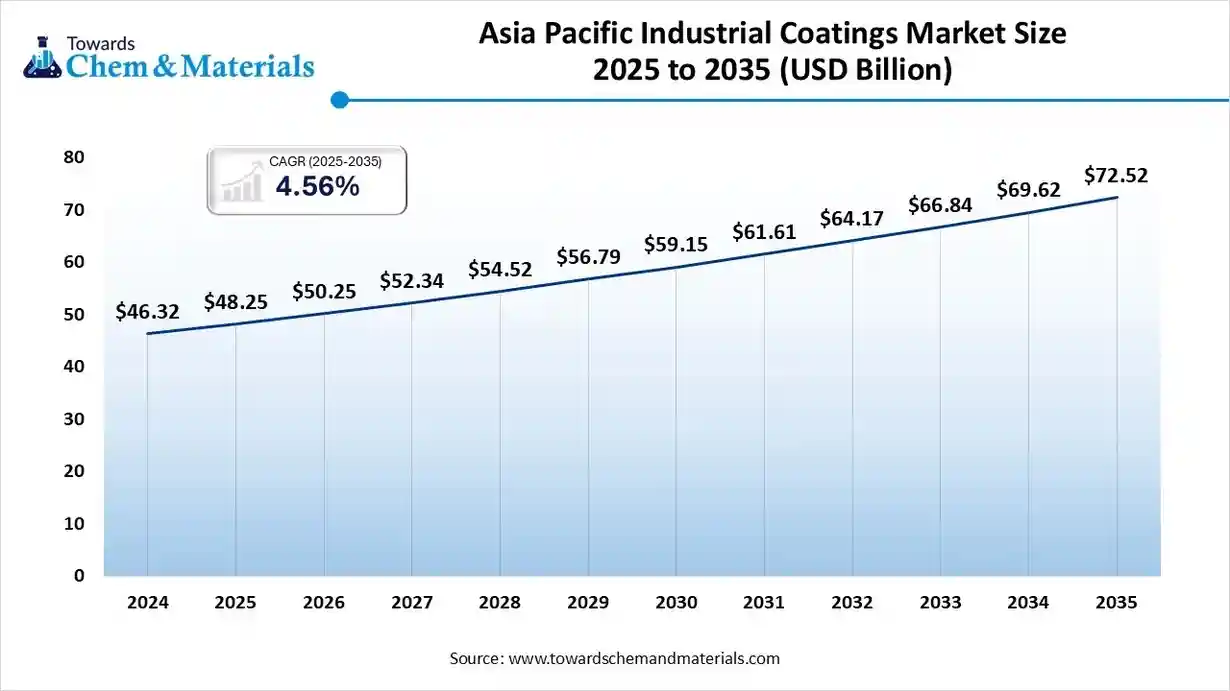

The Asia Pacific industrial coatings market size was valued at USD 48.25 billion in 2025 and is expected to reach USD 72.52 billion by 2035, growing at a CAGR of 4.56% from 2026 to 2035.Asia Pacific dominated the market, Asia Pacific dominated the industrial coating market and accounted for the largest revenue share of 40.19% in 2025.

The Asia Pacific market is shifting towards sustainable manufacturing, driven by strict environmental mandates. Water-borne and powder formulations are replacing solvent-based systems to cut VOC emissions. Technological advances like nanotechnology and smart coatings are vital for maritime and infrastructure projects. The rise of electric vehicles, while Industry 4.0 technology automates color matching and application, aims to reduce waste. Urban development promotes cool-roof technologies, supported by bio-based resins and circular economy practices.

How is Europe expected to Grow Fastest in the Industrial Coatings Market During Forecast Period?

Europe’s market is driven by the adoption of bio-based and circular chemistries, with a focus on plant-derived resins to meet decarbonization goals and eco-friendliness. Innovations include self-healing and anti-fouling systems that extend infrastructure longevity. The region focuses on digital transformation, powered by AI for formulation and application, enhances efficiency and reduces waste. The regional shift towards electric mobility further boosts demand for dielectric and fire-retardant coatings, with AI tools ensuring application precision.

North America Industrial Coatings Market

The industrial coatings market in North America is anticipated to grow at a significant CAGR during the forecast period, supported by a mature industrial base, high replacement demand, and strong presence of oil & gas, aerospace, and automotive manufacturing. The region continues to benefit from technological innovation, strict performance standards, and increasing adoption of high-value, low-VOC, and specialty coating solutions.

U.S. Industrial Coatings Market Trends

The industrial coatings market in the U.S. accounted for the largest market revenue share in North America in 2025, underpinned by ongoing investments in infrastructure refurbishment, energy transition projects, and advanced manufacturing. Demand is further strengthened by stringent regulatory frameworks, high spending on asset maintenance, and strong uptake of water-borne, powder, and high-performance protective coatings across industrial applications.

Central & South America Industrial Coatings Market Trends

The industrial coatings market in Central & South America’s is driven by industrial expansion, infrastructure development, and growing investments in oil & gas, mining, and automotive manufacturing, particularly in Brazil and Mexico. While price sensitivity remains high, gradual adoption of durable and environmentally compliant coatings is supporting steady market growth.

Middle East & Africa Industrial Coatings Market Trends

The industrial coatings market in Middle East & Africa is supported by large-scale investments in oil & gas infrastructure, power generation, marine assets, and industrial construction. Demand is primarily driven by the need for high-performance corrosion-resistant coatings suited for harsh operating environments, with long-term growth underpinned by industrial diversification initiatives and infrastructure modernization programs.

More Insights in Towards Chemical and Materials:

- Thermal Spray Coatings Market Size to Hit USD 24.82 Billion by 2035

- Waterborne Coatings Market Size to Surpass USD 166.38 Bn by 2035

- Liquid Paints & Coatings Market Size to Surge USD 246.39 Bn by 2035

- Automotive Paints & Coatings Market Size to Hit USD 48.22 Bn by 2035

- Biopolymer Coatings Market Size to Reach USD 109.08 Bn by 2035

- Paints and Coatings Market Size to Hit USD 348.04 Bn by 2034

- Automotive OEM Coatings Market Size to Reach USD 25.25 Billion by 2034

- Sustained Release Coatings Market Size to Hit USD 1,373.63 Mn by 2034

- Low-VOC Coatings Market Size to Reach USD 15.16 Billion by 2034

- Functional Coatings Market Volume to Hit 13.14 Million Tons by 2034

- Wood Coatings Market Size to Worth Around USD 20.36 Bn by 2034

- Green Coatings Market Size to Surpass USD 145.19 Billion by 2035

- Powder Coatings Market Size to Surpass USD 31.26 Billion 2035

- Concrete Floor Coatings Market Size to Surpass USD 8.99 Billion by 2035

- Flat Glass Coatings Market Size to Hit USD 16.86 Billion by 2035

- Pipe Coatings Market Size to Hit USD 17.75 Billion by 2035

- Nanocoatings Market Size to Reach USD 92.17 billion by 2035

- Self-Healing Coatings Market Leads USD 39.16 Bn at 28.42% CAGR

Industrial Coatings Market Top Key Companies:

- BASF SE

- Akzo Nobel N.V.

- Axalta Coating Systems

- Jotun

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- Hempel A/S

- RPM International Inc.

- Diamond Paints

- Kansai Paints

Recent Developments

- In November 2025, AkzoNobel and Axalta Coatings Systems announced an agreement to combine in an all-stock merger of equals for making premier global coatings company. The merge focus on a stronger revenue growth and improving profitability for customers.

- In November 2025, AkzoNobel and Axalta announced an all-stock merger of equals, creating one of the world’s largest coatings entities with broad portfolios across industrial, protective, marine, and mobility coatings, significantly reshaping competitive dynamics.

- In November 2025, Wesco Group entered an agreement to acquire National Coatings & Supplies, expanding its distribution footprint in industrial and automotive refinish coatings markets in North America.

Industrial Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Powder Coatings Market

- Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2035)

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyesters

- Other Products

- Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2035)

- Solvent Borne

- Water Borne

- Powder Based

- Other Technologies

- End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2035)

- General Industrial

- Marine

- Automotive & Vehicle Refinish

- Electronics

- Aerospace

- Oil & Gas

- Mining

- Power Generation

- Other End Uses

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6021

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaEveningPost.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaEveningPost.com takes no editorial responsibility for the same.